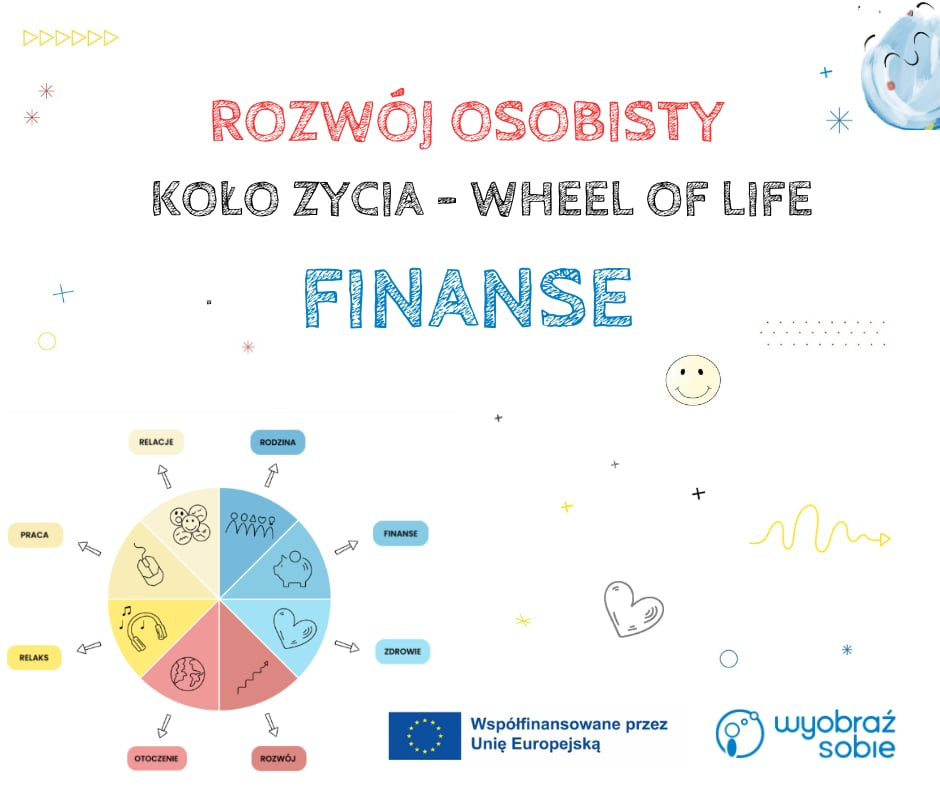

The Wheel of Life - Finances

Within "The Wheel of Life" international project for adult learners for 8 months we explore following 8 areas of "The Wheel of Life" exercises: Family, Relationships, Work, Finances, Relax, Health, Environment, Self-Development.

Every month as partner organizations we:

- Meet at the beginning of the month to exchange experiences and brainstorm together various tools, inspirations and approaches connected to the theme of the month, which can support our adult learners in their educational journey.

- Write 4 posts in national languages to share some of the tools with our target groups through social media.

- Organize offline and online workshops to explore 2 topics chosen by our target groups from each area.

- Write an article on EPALE to share our experience.

January 2025 was dedicated to Finances and the topics which our adult learners considered the most important were home budget and methods for saving money. Through posts as well as offline and online workshops we shared with them various tools, articles, methods and inspirations within those two topics and some of them we collect below so they can serve the wider community of adult learners and educators.

Beliefs

Before even exploring methods of saving or managing money, it’s good to look at our beliefs connected to that topic. We can do it through the spontaneous writing method. Take a piece of paper and for 5-7 minutes write everything which comes to your mind about money. Through this spontaneous writing, we try to identify our beliefs around that topic. If we believe that money is dirty or that we are not able to save money, we will not go very far with any of the methods proposed below.

After a few minutes of writing, analyze what you wrote and see what your beliefs are. Do you have a positive attitude toward money and your ability to earn it? Are you scared of money? What’s your view on people who earn money or save money? Identify any limiting beliefs which may stop you from developing in the area of finances. To work with it you may continue the spontaneous writing method or invite a friend to have a conversation around the questions below:

- Name your beliefs /choose the belief about money you want to work with.

- What do you do/not do thanks to this belief? How does it protect you? How do you benefit from it?

- What do you lose because of this belief?

- What are the exceptions? Describe the situations which deny your belief, and prove your belief is not always true.

- Do other people believe in your belief? What would they (a particular person) tell you about it?

- What belief do you want to have instead? What belief will be more useful/supportive for you? What belief will still protect you but at the same time enable your full potential/help you to achieve your goals?

- On a scale 0-100% how much do you believe in the new belief?

- What proves that your new belief is true? Give examples showing that your new belief is true.

- What can help you to believe more in your new belief?

Home budget

One of the first crucial steps in the topic of finances is to know exactly how much money we get and how much we spend. Below we share an example of a simple home budget which can be used to track our income and expenses. Most of us believe that we know what we spend money on, but very often after writing things down, we are surprised to discover how much money we spend in some of the categories. Already knowing it brings motivation to change and a clear indication of where the change could start from.

Example of home budget: https://consumer.gov/sites/default/files/pdf-1020-make-budget-worksheet_form.pdf

Financial goal

As in any other area, knowing what helps us to achieve it. Define your financial goal. You can use the SMART technique which says that our goal should be Specific, Measurable, Attractive/Ambitious, Realistic and Time-framed.

What do you want to achieve in the area of finances in 2025? Earn 10% more? Put aside at least 100 euro each month? Put aside 300 euros for investments or a specific purchase at the end of the year? A financial goal builds motivation and sets the direction of our financial actions.

Write your goal down and share it with at least one person.

Saving money

Have a look at the List of saving ideas inspired by the Polish blog https://jakoszczedzacpieniadze.pl/. Choose 5 which you want to experiment with and introduce to your life:

Food

Go shopping with a list and don't purchase anything outside of your list.

Don't overpay on food.

Limit sweets and sodas.

Limit eating out, prepare homemade food for school or work.

Make preserves and your own products.

Make wholesale purchases for yourself and your friends.

Bank, finances

Change your bank account to one with no fees.

Close unused bank accounts.

Exchange your currency in an online exchange office (banks take a bigger fee).

Save on debts - pay on time, determine the optimal order for paying off debts.

Negotiate interest rates on credit card debts (and other things).

Automate payments for monthly services.

Cut credit cards if you can't cut debt.

Insurance

Search for the cheapest insurance for your car - preferably 2 months before the deadline.

Actively seek discounts.

Pay the insurance with one annual fee.

Transport

Choose the optimal means of transport.

Become an Honorary Blood Donor.

Drive with your friends to work.

Drive the car economically.

Drive and park in accordance with the regulations - avoid fines.

Replace the car with a bicycle.

Hand-wash your car.

Change the car to a more economical one.

If you don't have a car, think carefully before buying it.

Household fees and expenses

Do you rent an apartment? Move closer to work.

Consider changing electricity suppliers.

Make good use of the day / night tariff.

Minimize the number of devices in standby mode.

Disconnect unused devices from the main net.

Replace lighting with energy-saving one.

Cancel unnecessary subscriptions.

Take care of the refrigerator - it is responsible for 25% of electricity consumption in homes.

Do not run the dishwasher until it is full.

Use home-saving hygiene: turn off the lights, close the tap, splash less water in the toilet, seal leaks.

Learn to use heating wisely.

Change your mobile operator.

Turn off all unnecessary telecommunications services - analyze the bill telephone.

Replace a live Christmas tree with an artificial one.

Clothes

Visit second hand shops.

Use store sales wisely.

Sell or give away clothes you don’t use anymore.

Entertainment

Search for cheap or free entertainment.

Read free newspapers and magazines lined up for shared use.

Buy magazines with friends (in turns).

Use the library.

Borrow books from friends and relatives.

Are you a "collector"? Think about what you need it for.

Don't spend a fortune on kids - you can play with your kids cheaply with a bit of invention.

Other shopping

Take advantage of loyalty programs.

Make gifts yourself.

Give your services instead of buying products, e.g. looking after children.

If you have to buy gifts, buy them all year round.

Avoid impulsive purchases.

If you want something, put it on the gift list for yourself.

Do not take your children to shopping - in particular, to shopping centers and hypermarkets.

Don't consider shopping as a de-stress method.

Return the products to the store if you change your mind.

Buy cheaper on the Internet.

Use discount coupons and group purchase services.

Produce household chemicals - washing powder, soap and other cosmetics.

Other

Sell unnecessary items - Allegro, Gumtree, etc.

Give away unnecessary items.

Get rid of unnecessary electronics quickly.

Use barter trade.

Return metal, plastic, paper and electro-waste to collection centers.

Changing habits

Don't watch too much TV.

Quit smoking, alcohol and other stimulants.

Don't go to the movies on weekends.

Put your change into a piggy bank.

Write down expenses and plan expenses.

Convert purchases to the number of working hours.

Learn to talk to yourself - Ask yourself “Do I really need it?" and "Why do I want to buy it?"

Don't blame yourself if you fail.

Read good personal finance blogs.

Don't be selfish and exchange information with your friends.

Make your own list of saving ideas.

Additional resources

In English:

In Polish:

- https://jakoszczedzacpieniadze.pl/

- https://atlaspasywnegoinwestora.pl/

- https://racjonalne-oszczedzanie.blogspot.com/

- http://www.regularne-oszczedzanie.pl/

- https://gdzietylkochce.com/

- https://kobiecefinanse.pl/

- https://oszczednicka.pl/

In Slovenian:

- https://mojefinance.finance.si/ (magazine & online portal)

- https://www.facebook.com/vezovisek (counselling)

- https://emka.si/pages/ana-vezovisek (Slovenian books that participants can find in public libraries)

- https://www.finance.si/ (online newspaper)

The "Wheel of Life project" is co-financed by the European Union. Its main objective is to prepare, test and share tools of holistic development for adult learners in 8 key areas: Family, Relationships, Work, Finances, Relax, Health, Environment, Self-Development. The project is implemented by two organizations: Fundacja Wyobraź sobie from Poland (leader) and ASPIRA from Slovenia (partner).

Re: The Wheel of Life – Finances

Dear Aneta,

Thank you for sharing insights from The Wheel of Life project! Financial development is a crucial aspect of lifelong learning, and it’s inspiring to see such initiatives supporting adult learners. Looking forward to learning more about the project's impact and future steps.